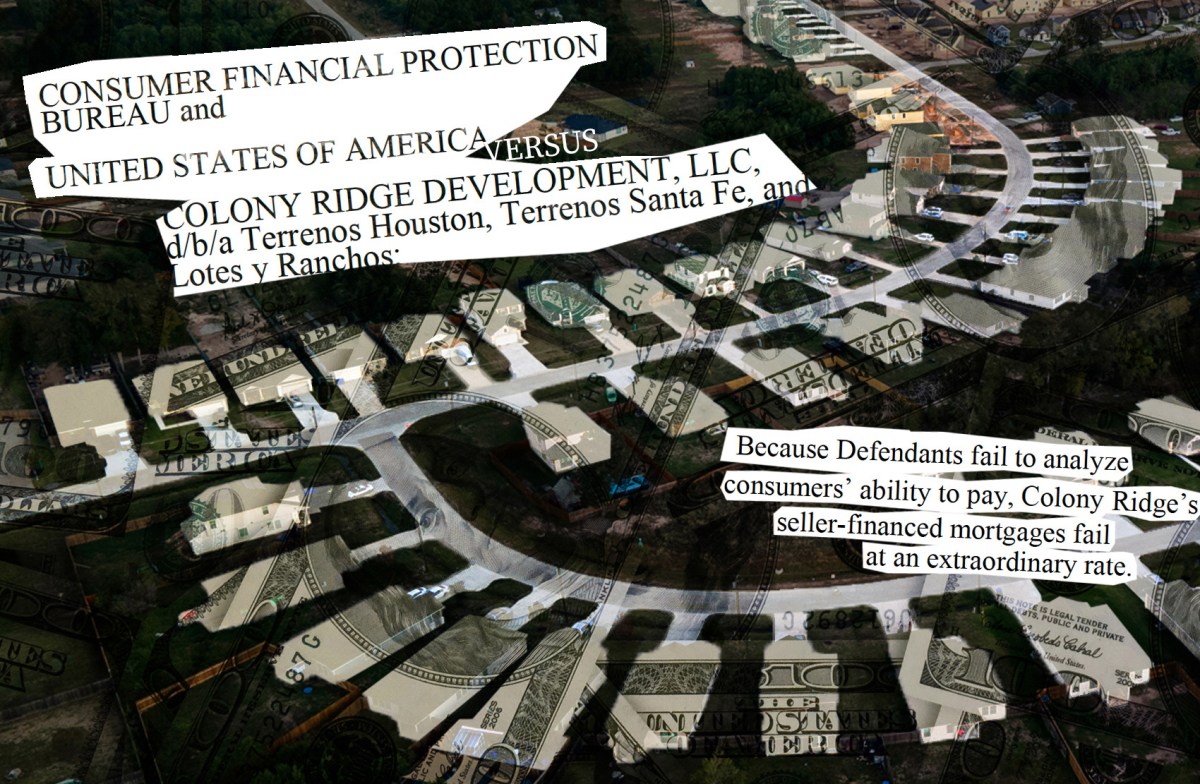

A judge rejected an attempt by lawyers for the Colony Ridge housing development to dismiss the civil lawsuit brought against the company by the Department of Justice and the Consumer Financial Protection Bureau alleging it unjustly targeted Latino land buyers.

Judge Alfred Bennett’s ruling represents a victory for the Department of Justice, which is making a novel legal argument in its first-ever predatory mortgage lending case: that Colony Ridge violated federal law by engaging in reverse redlining, or the practice of extending credit on unfair terms specifically to Latino buyers.

While Bennett threw out a claim that the Liberty County land developer had violated the Fair Housing Act (FHA) by effectively denying land to Latino buyers because its in-house loans were designed to fail from the outset, the Barack Obama appointee allowed all other claims in the lawsuit to proceed.

Ari Cuenin, who represents Colony Ridge, rejected the reverse redlining claim during an August hearing at the federal courthouse in downtown Houston. Cuenin argued then that neither the U.S. Supreme Court nor the Fifth Circuit – the appellate court for the Southern District of Texas – had recognized it under the Equal Credit Opportunity Act (ECOA) and that Bennett should follow suit. He also said the government failed to meet the appropriate legal standard for reverse redlining.

Bennett disagreed, writing in a 16-page order issued Friday that the “allegations, taken as true, easily satisfy the elements of a reverse redlining claim.

“As such, plaintiffs plausibly allege that Colony Ridge discriminated against Hispanic consumers, as required for an Equal Credit Opportunity Act claim.”

In a statement, Colony Ridge developer John Harris said, “There are many positives to this ruling,” though he did not specify what those were. “We will continue to vigorously defend other allegations in this lawsuit,” he added.

Led by Harris and his brothers, William “Trey” Harris and Kevin Harris, Colony Ridge is a massive housing development in unincorporated Liberty County about 30 miles northeast of Houston. Many of the people who moved there in the past decade are Latino, drawn by the prospect of affordable land on which to build a home.

Harris’s company offers loans with interest rates of 12.9%, significantly higher than the market average. Federal prosecutors accuse the developer of exploiting borrowers’ limited English proficiency and pushing them into loans they cannot afford. The Justice Department also alleges Colony Ridge lies to its customers about the conditions of the land and what it will cost to install water, sewer and electrical infrastructure.

Colony Ridge faces a lawsuit from Texas Attorney General Ken Paxton that makes similar allegations.

In the same order denying Colony Ridge’s motion to dismiss, Bennett threw out allegations that a mortgage company Colony Ridge worked with had discriminated against Latino borrowers. He gave federal prosecutors the option to amend their complaint against Loan Originator Services, which created loan documents for Colony Ridge. The Consumer Financial Protection Bureau, whose prosecutors handle the case, declined to comment on Bennett’s ruling and potential next steps.

With Bennett’s ruling on the pre-trial motions, the case can now proceed to the discovery phase, where the parties formally exchange the information they’ll be using at the trial. This process is expected to last through much of next year.

Citizenship information has proved to be a potential sticking point, however. In a motion for a protective order, prosecutors said having victims or witnesses disclose their immigration status would be “oppressive, intimidating, unduly burdensome and harassing, given the potential consequences to those individuals.”

Attorneys for Colony Ridge said the motion is premature and that they are willing to negotiate with the Justice Department over the terms of discovery. Bennett, in urging both sides to come to an agreement, said in August that knowing a person’s immigration status might be useful in determining whether it affected them obtaining a loan from Colony Ridge.

“It seems that we’re talking about two classes of people: witnesses whose credit is not at issue and those we’re calling the aggrieved persons who may have been treated differently because of their credit and their credit could be tied to immigration status,” he said.

Update, Sept. 17, 3:15 p.m.: This story has been updated to include a comment from Colony Ridge Developer John Harris.